Liberation Day 2.0 or a blip in the bull market?

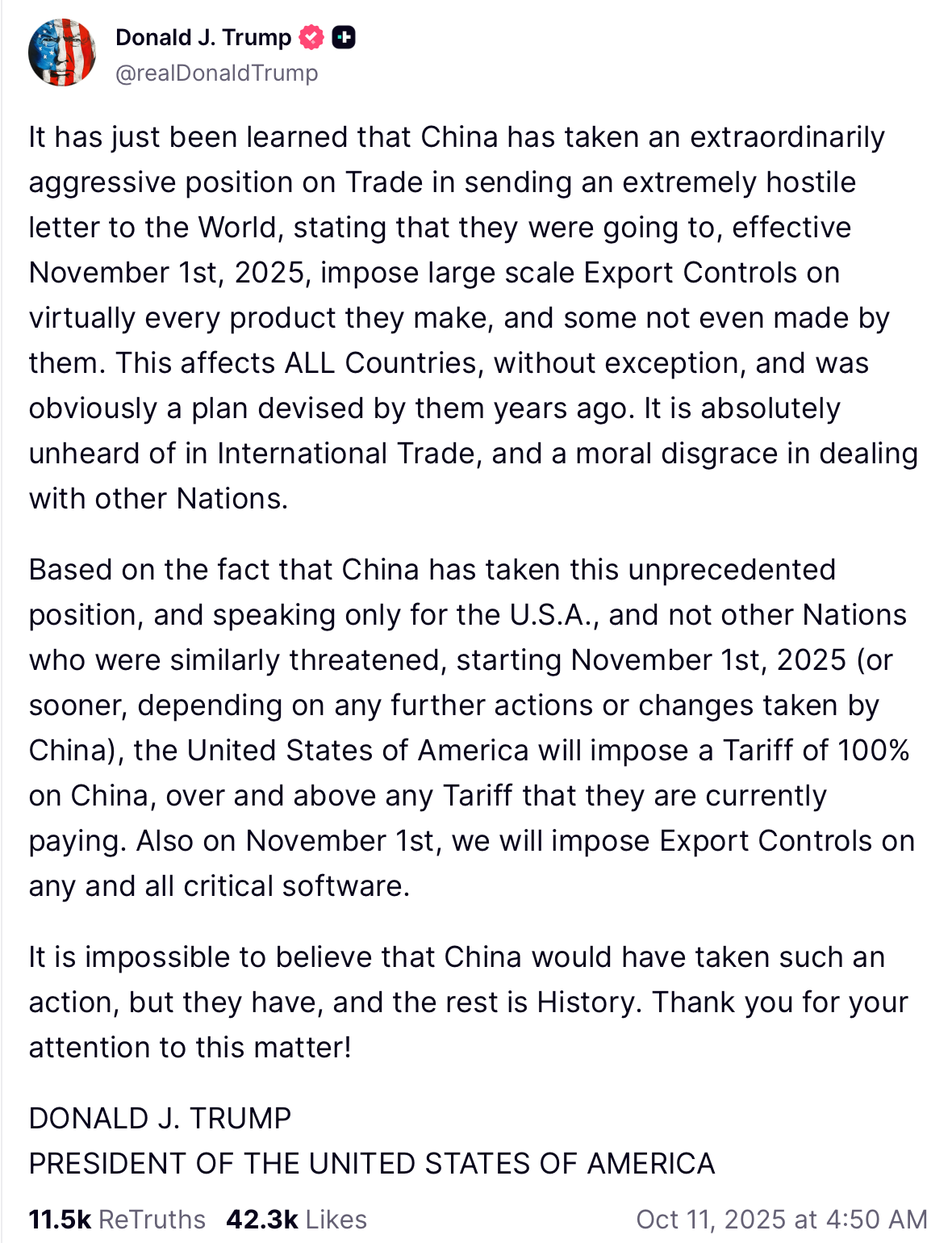

Equities saw their largest selloff since April after Trump announced an increase of tariffs on China to 100% in retaliation for rare earth export controls that China recently imposed on the rest of the world.

The financial press points to China’s announcement on Thursday of curbs on rare earth exports as the main instigation for Trump’s tariffs, but this renewed conflict actually started to brew a couple weeks ago. On September 29, the Bureau of Industry and Security implemented the 50% rule - a regulation that extends US sanctions to entities that are more than 50% owned by companies or individuals on the US Entity List. China was not happy about this rule, and their Ministry of Commerce denounced it as an abuse of export controls that would disrupt international trade.

On October 8th, the US Customs and Border Protection announced that they would start collecting fees on Chinese ships docking in the US. Once again, China’s Ministry of Commerce denounced the new rules as being disruptive to trade and being in violation of bilateral maritime agreements.

On Thursday, China finally hit back. They announced export controls on five rare earth metals, adding to the seven metals already on the restricted export list. They also announced export controls on any tech products containing more than 0.1% of its value in rare earths. The curbs apply not only to the U.S. but to all countries importing Chinese goods - covering nearly every advanced technology product, from smartphones and TVs to computers and semiconductors. Without access to these metals, the supply chain for GPUs powering America’s AI boom would grind to a halt.

The significance of these curbs cannot be understated. Until recently, the U.S. believed that they had a wide lead over China in the semiconductor industry, thanks to its export restrictions on high-end semiconductors to China. In an interview by Howard Lutnick that angered Chinese officials, Lutnick said “We don’t sell them our best stuff, not our second best stuff, not even our third best. The fourth one down, we want to keep China using it. We want to keep having the Chinese use the American technology stack, because they still rely upon it.”

China’s rare earth restrictions flipped that narrative. They reminded the U.S. that Beijing controls a critical chokepoint in the semiconductor supply chain and, by extension, holds sway over America’s ambitions for global AI dominance. With the U.S. economy and equity markets now heavily reliant on the AI boom, China’s leverage through its rare earth monopoly arguably exceeds Trump’s through his 100% tariffs.

A Q&A released today by China’s Ministry of Commerce hints at a possible off-ramp in the tit-for-tat escalation. The Chinese official outlined a series of grievances and warned that China is prepared to take “resolute measures to protect its legitimate rights and interests.” However, the statement stopped short of announcing retaliatory tariffs - an escalation that would likely have triggered further risk-off selling.

More importantly, China emphasized that its export controls are “not export bans,” and that licenses and exemptions would be granted to “jointly maintain the stability of global industrial and supply chains.” This clarification marks an initial step toward de-escalating the renewed trade tensions and can be read as an invitation for Trump to reconsider his announced tariffs. China’s rare earth export controls may have simply been a reminder to Washington that Beijing holds the stronger hand in trade negotiations and that the U.S. would do well to tread carefully.

The current selloff presents an opportunity to buy the dip and position for a continuation of the bull market. When I zoom out on the business cycle, what I see is an equity bull market that has a long runway. Bull markets typically end when growth and inflation overheat, forcing the Fed to overtighten to slow down the economy. Today the Fed is still cutting and not concerned about the need to tighten yet. Next year’s Fed will have a more dovish composition, and goods inflation will likely decelerate due to base effects from this year’s tariffs. If anything, the risk is that the bull market accelerates into an even more overheated bubble, with AI and the AI-driven resource boom at the center of it.

Paul Tudor Jones explains it well in an interview from last week:

My guess is that I think all the ingredients are in place for some kind of a blow off. Will it happen again? History rhymes a lot, so I would think some version of it is going to happen again. If anything, now is so much more potentially explosive than 1999. We were looking at a rate hike in November. Now we’re looking at a rate cut. We were looking at four more rate hikes before we actually topped in 2000. Now we’re looking at 3 or 4 rate cuts at least. So you have monetary policy that’s going to take us to real rates of zero or less, probably depending upon the next Fed chair. And then the big difference is obviously fiscal policy. We had a budget surplus in ‘99-00. Now we’ve got a 6% budget deficit. So that combination, that fiscal monetary combination is a brew that we haven’t seen since, I guess the postwar period, early ‘50s, something like that. And that was crazy times, right?

George Soros, another legendary global macro investor, said “When I see a bubble forming, I rush in to buy, adding fuel to the fire. That is not irrational.” My sentiments align with PTJ and Soros. I’ve experienced numerous bubbles firsthand, including 1999 and 2021, and observed that those who focused on narrative, sentiment, and momentum made the most money. Investors who care about valuations and fundamentals sat out and underperformed the market.

Trading plan for this week

In this section for paid subscribers, I discuss what assets I want to buy on this dip and how I plan to trade crypto and precious metals.