Navigating the US growth scare

The recent weak employment data has ushered in another growth scare in the US - the fourth growth scare since the inflation spike and aggressive rate cuts of 2022. I define growth scares as periods when the probability of recession increases and the rates market prices in a drop in the terminal rate Fed funds rate to 3% or lower. The scare can be caused by endogenous factors such as restrictive monetary policy or exogenous factors such as a regional banking crisis (Silicon Valley Bank) or trade tariffs. In hindsight, each “scare” ended up being nothing more - just another bump in the business cycle that provides the market an opportunity to buy the dip in risk assets. The chart below shows the generic 6th SOFR futures contract (where the market thinks SOFR rates will be six quarters out) has done over the last three years - a representation of how the terminal rate has reacted to previous growth scares.

Each growth scare sent sixth SOFRs above 97.00 (below 3.00% in interest rate terms), resulting in an easing of financial conditions that helped risk assets recover. Each scare was met by a powerful policy response that helped the equity market recover, and in the case of the S&P 500, reach a 12-month high each time.

Growth scares and their policy responses

Silicon Valley banking crisis, Mar 2023

Injection of net liquidity via BFTP lending program

Pause in rate hikes

Yen carry trade unwind, Aug 2024

100 bp of cuts over following three meetings

Trump trade tariffs, April 2025

Significant walk-back of tariff escalation by Trump administration

Each time, the playbook was to identify the crisis as it unfolded and go short equities and long bonds. Once prices overshot due to forced liquidation of short vol and long risk positions, I flipped to long equities and short rates to capture the recovery.

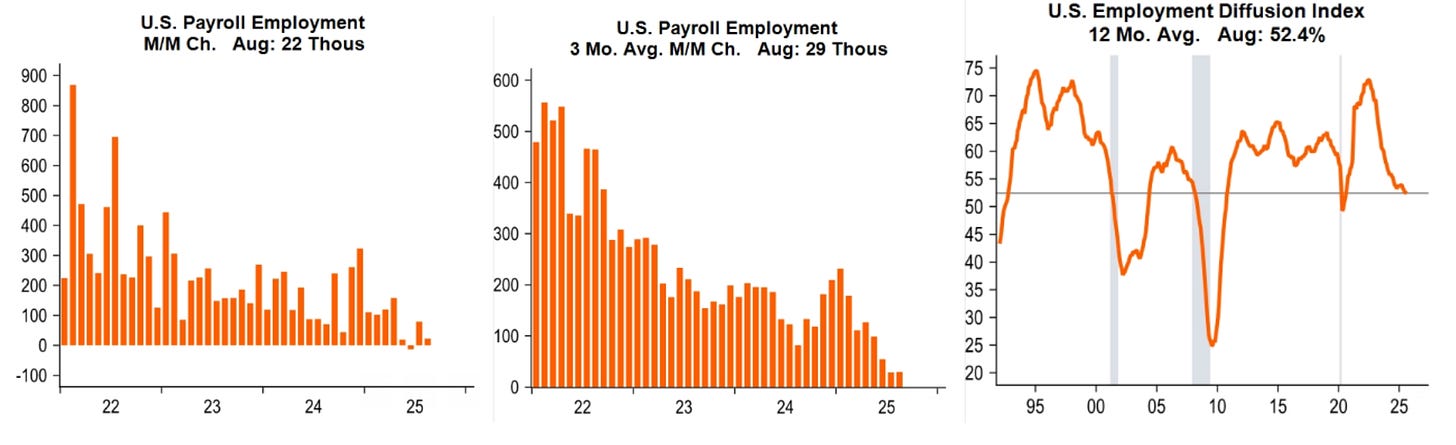

This brings us to the current growth scare, which can’t really be called a scare yet because equity markets have barely sold off in response to weak employment data. Long term employment trends are the weakest they have been this cycle and are declining at a trajectory consistent with past recessions.

Despite the weak data, equity markets have barely blinked as they are confident that the Fed will respond quickly and forcefully. A decline in the supply of labor due to Trump’s tighter immigration policies also means that less employment growth is required to keep the unemployment rate at a constant level.

We are in an unstable equilibrium, waiting for the next shock to determine the market’s direction. Just because the market hasn’t sold off on the weak data doesn’t mean the coast is clear. I believe the Fed must cut at least 100 bp over the next several meetings as a precondition for the economy to recover, but the Fed might exercise restraint in cutting without a signal from the market that forceful cuts are needed.

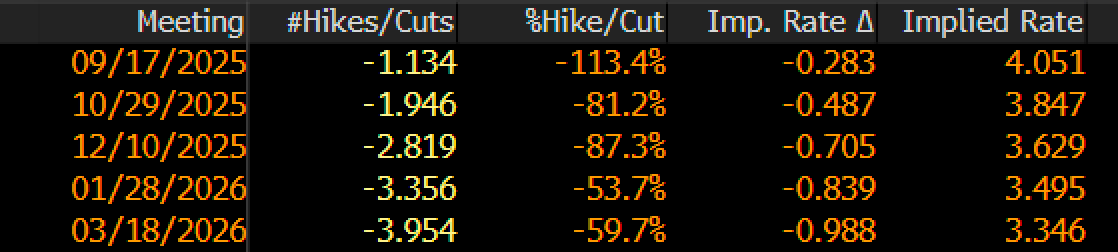

One way I can envision the next month playing out is the following scenario. The market is pricing in three cuts over the next few meetings.

We can make the assumption that this is the minimum amount of cuts needed just to keep equity markets where they are. If a hawkish Fed or a hot CPI force the market to pare back expectations of cuts, this would trigger a selloff in equities and initiate the growth scare trading playbook that has worked well over the last several years.

I believe the Fed will ultimately cut close to 3%, bringing the Fed funds rate to neutral or slightly below. This would usher in a bullish quad 2 global macro regime where growth and inflation rising in tandem. If this scenario plays out, I will be aggressively buying the dip in risk and holding for a 6-12 month time horizon.

The following section is for paid subscribers

Current positions and views on gold and crypto