The end of the bull market or just a pause for precious metals?

And why US interest rates are mispriced

The dust is still settling from the Jan 30 collapse in precious metals. Prices went parabolic and a violent correction was an inevitable consequence of that. The magnitude and speed of the selloff surprised everyone, including me. The damage to both the charts and sentiment has led some to wonder if we have already seen the top for gold and silver.

A parabolic rise followed by a collapse often marks either a permanent top or the start of a prolonged correction. Given what is driving gold and silver demand, and where those drivers are headed, I lean toward this move being a correction within a longer bull market. Precious metals trade heavily on narrative and emotion, and Asian retail investors have adopted them as a preferred speculative vehicle. It will likely take time for weak hands to sell to stronger ones before a new uptrend can resume.

I’m looking to 2006 as an analog for what might play out in gold. 2006 saw a similar 25% collapse after a parabolic rise, followed by over a year of sideways choppy price action.

What followed, however, was a continuation of the bull market that ran for another five years and carried gold from the 2006 high of 730 to 1900 in 2011. The 25% correction in 2006 looks like a blip when you zoom out.

What else do 2006 and 2026 have in common? In 2006, gold was in the middle of a secular bull market that took the price from 300 in 2002 to 1900 in 2011, more than a sixfold increase. It was also a secular dollar bear market, with the dollar index falling from 120 in 2002 to 72 in 2008. Asian economies were running large current‑account surpluses by exporting to the United States, and their reserve managers needed to diversify growing dollar holdings into other currencies. I was on the FX trading desk at Royal Bank of Scotland at the time and saw China’s reserve managers calling several times a week to buy hundreds of millions in euros and other currencies while selling dollars. When the dollar trends as it did from 2002 to 2008, gold tends to trade as a high beta alternative to the dollar.

Today we are seeing echoes of that 2002‑2008 dollar bear market. Trump has signaled that he wants to reduce trade with Asian partners, which lowers the need for global reserve managers to hold dollars for trade settlement. China has been actively cutting its Treasury holdings and accumulating gold, both officially and unofficially. Trump has also eroded geopolitical trust in America’s willingness to safeguard foreign reserves held in Treasuries and U.S. securities. This shift began when the United States froze Russia’s Treasury holdings in 2022, continued with Trump’s “Liberation Day” tariffs in April 2025, and has persisted through his invasion of Venezuela and his threats last month to annex Greenland from Denmark.

Gold’s share of global reserves bottomed around 10% in the 2000‑2020 period, but began to rise after Covid in response to unprecedented monetary and fiscal stimulus. The pace accelerated after Russia’s invasion of Ukraine and is now increasing rapidly. I do not expect the gold bull market to end until its share of global reserves returns to levels last seen in the 1970s, roughly 50% or more. On that measure, we are only halfway through.

I also cannot discuss the correction in precious metals without addressing Trump’s choice of Kevin Warsh as the next Fed chair. The announcement was widely cited as the catalyst for the selloff in precious metals and the rally in the dollar, since Warsh has publicly supported shrinking the Fed’s balance sheet to reduce its role in the economy. At the same time, he is a Trump loyalist who has argued that interest rates are too high and should be cut further. His record as a Fed governor from 2006 to 2011 shows an inflation‑hawkish bias and philosophical opposition to quantitative easing. The open question is which version of Warsh will take charge when Powell hands over the chair in May.

My view is that Warsh’s stance on inflation follow his political loyalties rather than dogmatism on inflation. Warsh’s father-in-law is Ronald Lauder, a billionaire GOP donor who has known Trump since childhood. Warsh has deep ties with Republicans and Wall Street and had the strongest existing relationship with Trump out of all the Fed chair candidates going into the race.

Even if Warsh intends to carry out his two policy goals of reducing the Fed balance sheet and cutting interest rates further, there would be material constraints preventing him from reducing the Fed balance sheet any time soon. Repo funding markets became dysfunctional in Q4 of last year due to insufficient reserves in the banking system - a sign that the Fed’s QT program was adversely affecting monetary plumbing. The financial system relies on overnight repo financing via money markets to absorb the Treasury’s net issuance of hundreds of billions of Tbills and notes every week. When reserves are scarce, overnight repo rates spike to attract cash. Those spikes signaled that the system lacked the reserves needed to absorb Treasury supply, and that if the situation persisted the Fed could lose control of overnight rates and risk a broader market seizure. In response, the Fed announced in December that it would begin “reserve management” purchases of Treasury bills, effectively reversing course on balance‑sheet reduction. It is unlikely that the Board would quickly undo that decision simply because Warsh requests it. First, the Fed and regulators would need to change rules so that banks can hold more government securities than they currently do.

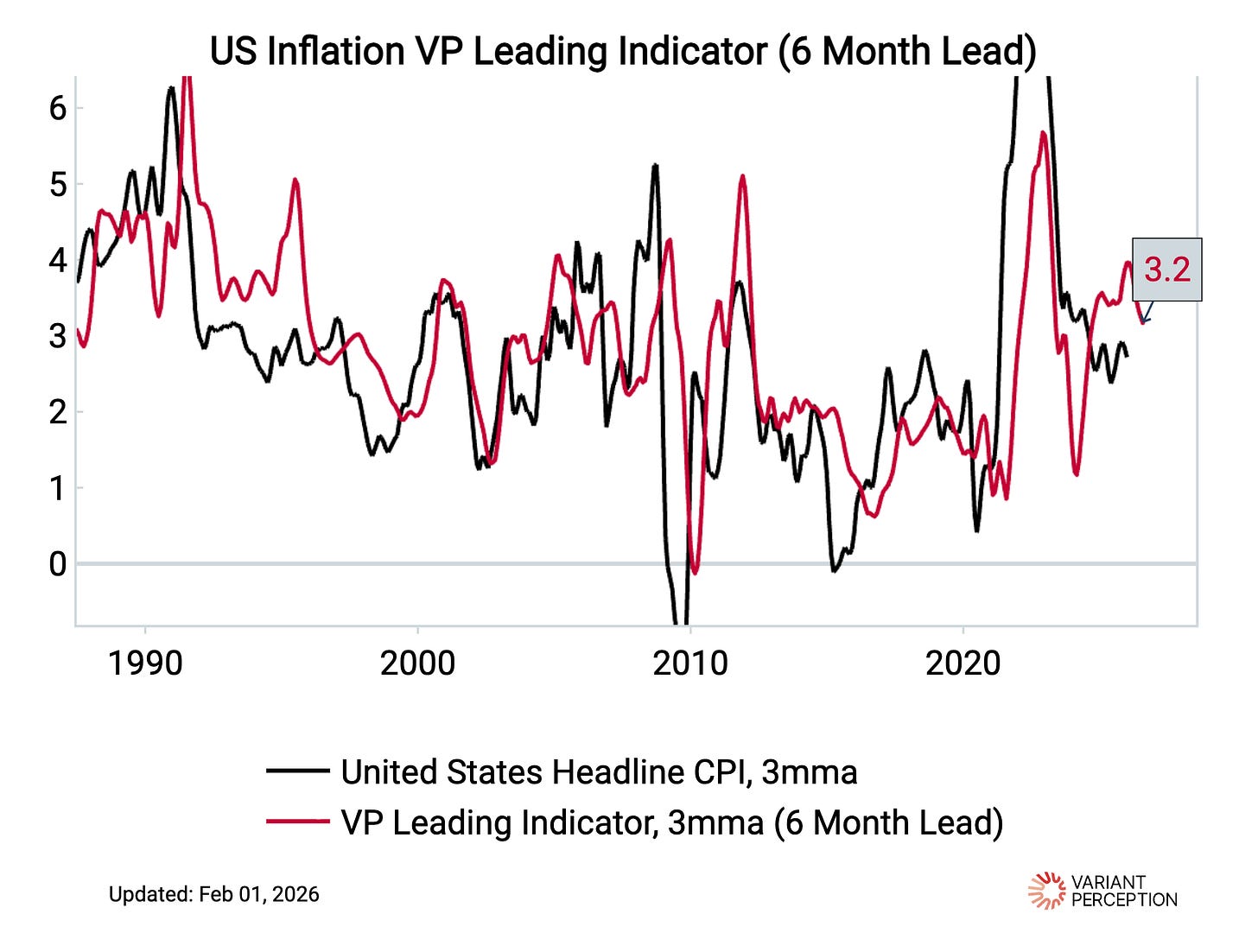

On the other hand, cutting rates at a faster pace than what the market is pricing in will be a much easier lift for Warsh. Employment should remain slack due to AI productivity gains, while inflation will likely roll over thanks to declining rent inflation and other factors. Variant Perception’s leading indicator of US inflation is rolling over:

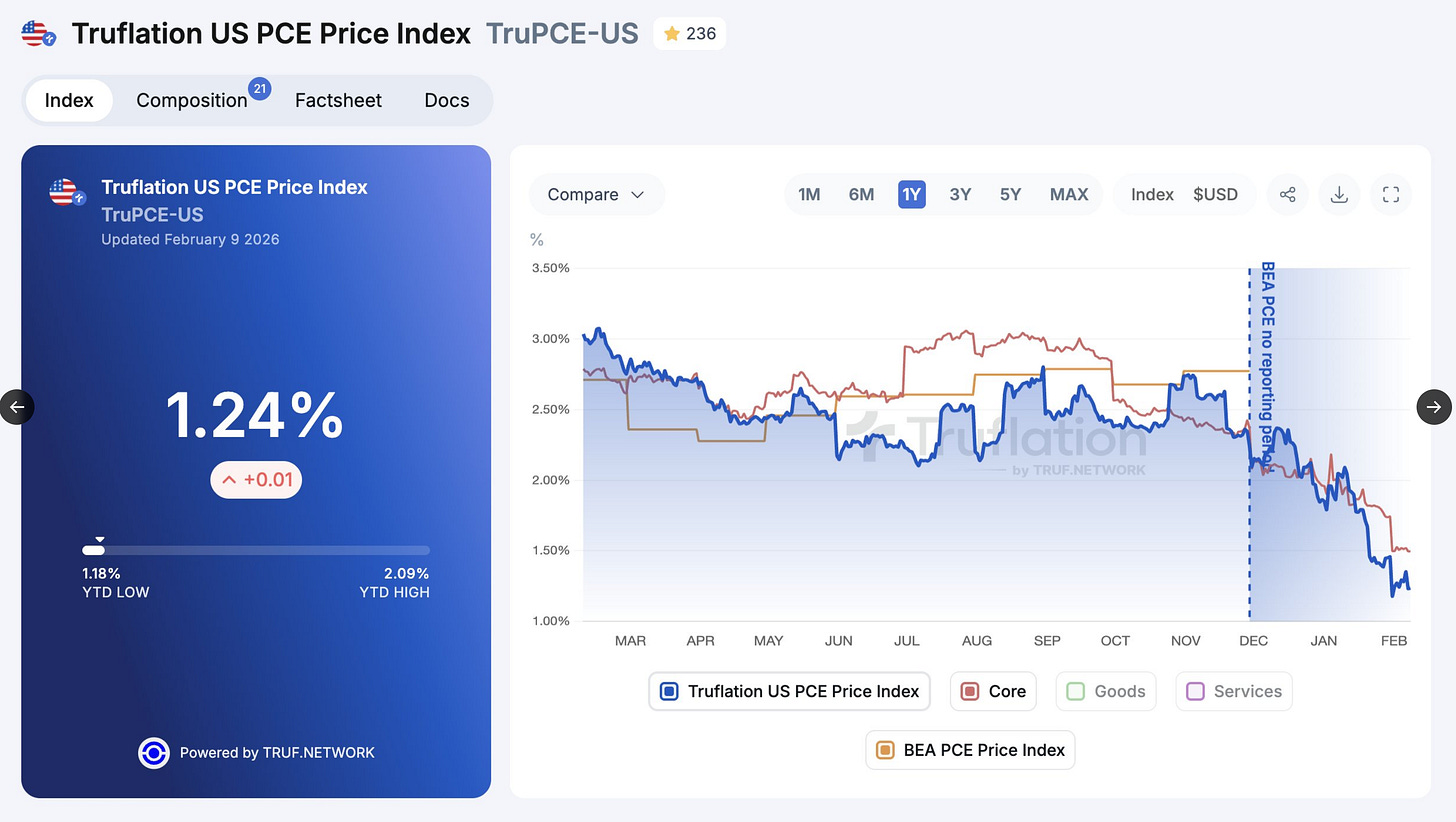

Meanwhile, the Truflation PCE index is taking a nose dive:

The market today is pricing in a terminal rate of 3.10%, but I’m willing to bet that Warsh cuts rates more aggressively than that - perhaps 25 bp every quarter until Fed funds reaches 2.50%. A repricing of the front end of this magnitude would push downward pressure on the dollar and upward pressure on gold.

To sum it up - the drivers for gold demand, both monetary and geopolitical, are directionally supportive for gold and will continue to be supportive for a while. I can see gold and silver trading in a wide range for a few months to a year as price finds an equilibrium and eventually resolving to the upside.

Behind the paywall:

My plan for trading precious metals over the following weeks

Updates on my current positions

A new position for the portfolio