The unfolding rotation into small caps and EM

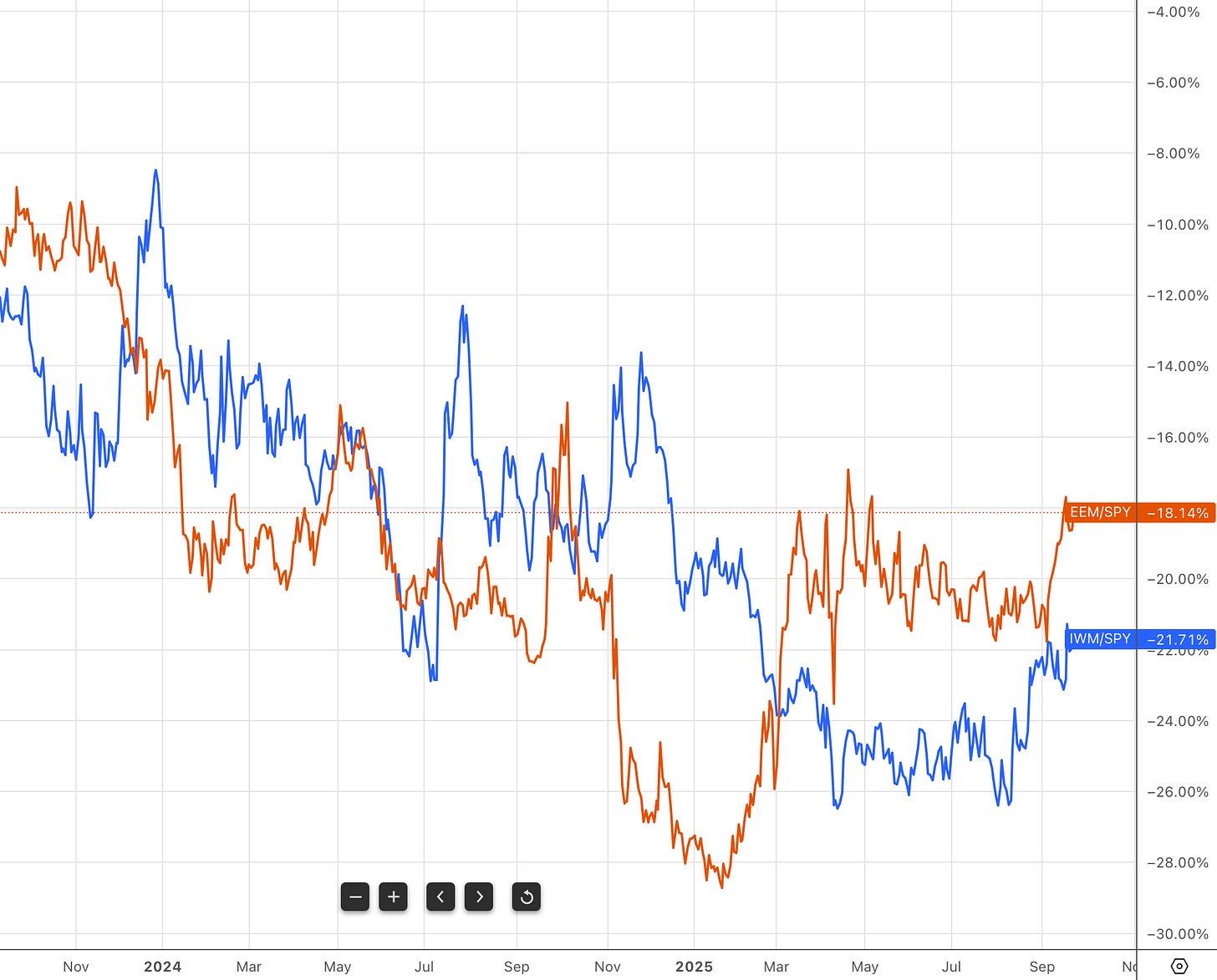

From 2023 until now, the U.S. markets have been a story of two economies. One is big tech and AI, and the other is everything else. Equity indices in the rest of the world also didn’t start outperforming until earlier this year when Trump announced his liberation tariffs in April. Since then, EM has outperformed the S&P 500, while the Russell 2000 small cap index is showing signs of making a relative bottom versus large caps. I expect the current Fed rate cut cycle to accelerate the outperformance of EM and small caps vs US large caps.

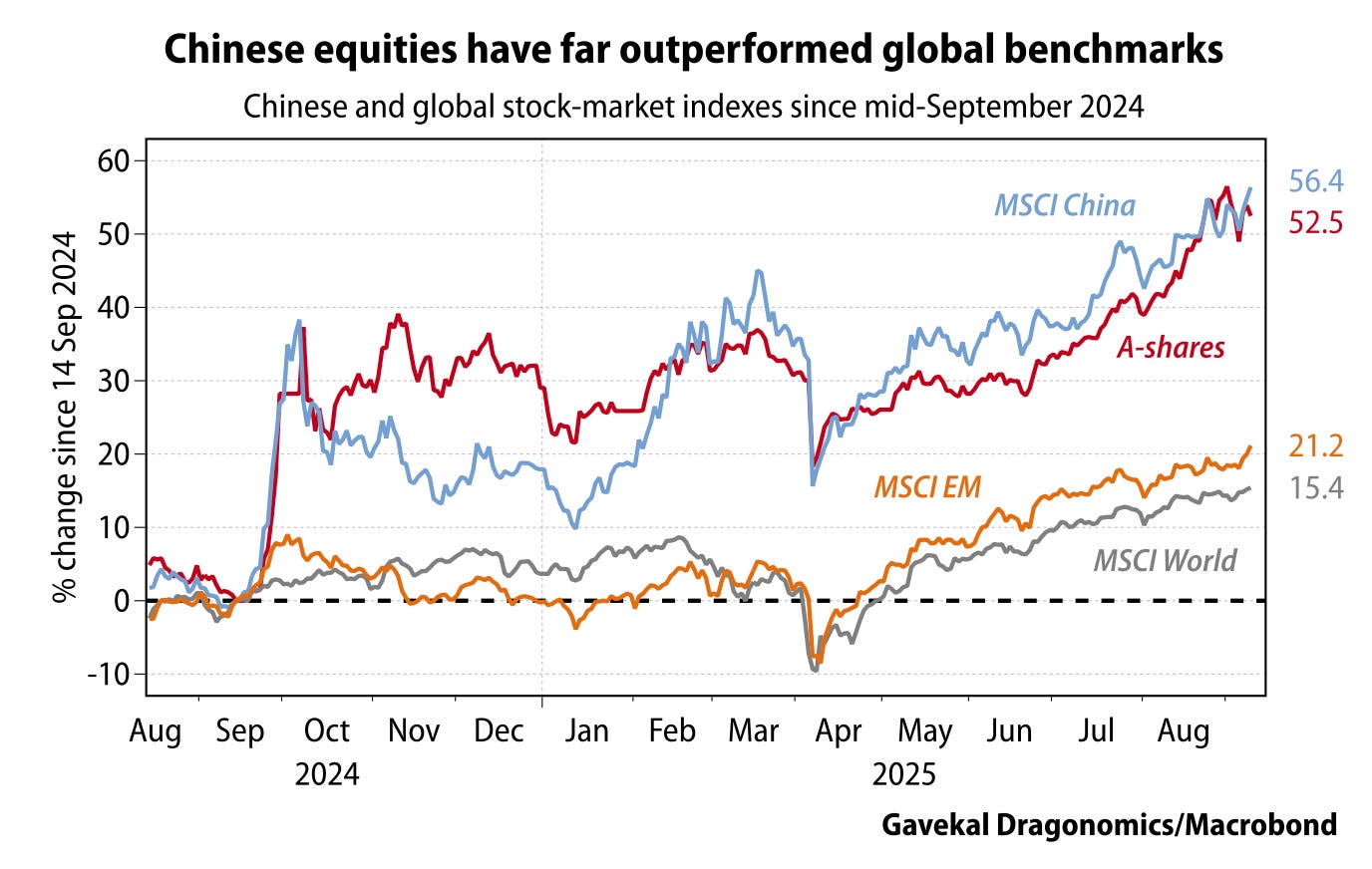

The rotation is being driven by factors both pushing investors out of big tech and pulling them into small caps and EM. The push factors include rich valuations in the S&P 500 and Nasdaq, high concentration risk, and questions about the sustainability of the current AI boom. The pull factors, in the case of EM, are specific to each economy. In China (which makes up the largest portion of EM indices), valuations are rising from a historical bottom, driven by fiscal stimulus, Xi’s anti-involution campaign relieving margin pressure, and excitement about China’s homegrown AI economy that is developing in parallel to the US.

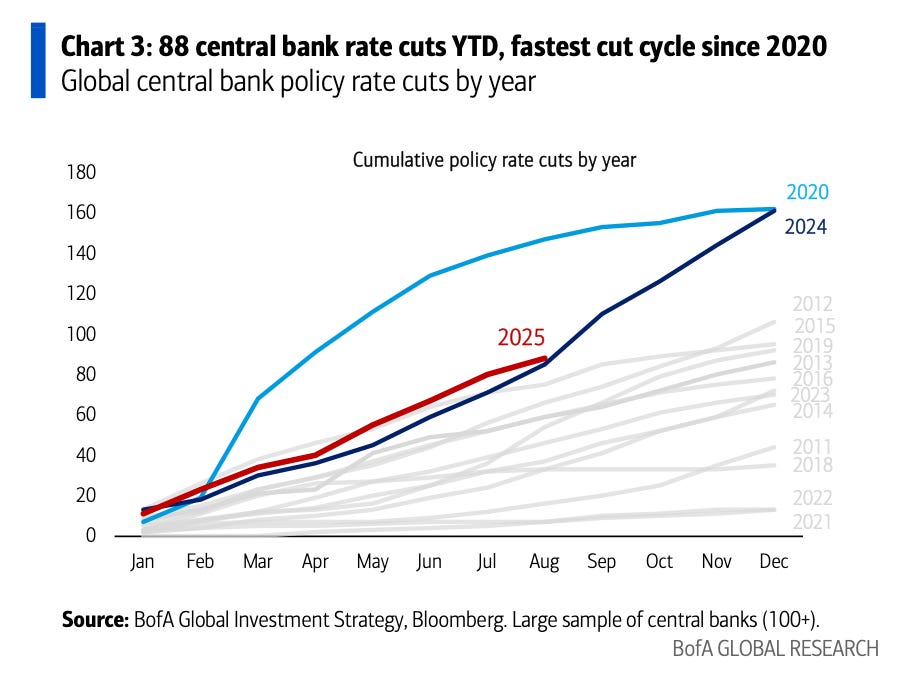

In general, EM has benefited from tailwinds of moderating inflation, global central banks cutting rates, and improving geopolitical uncertainty from the Trump administration.

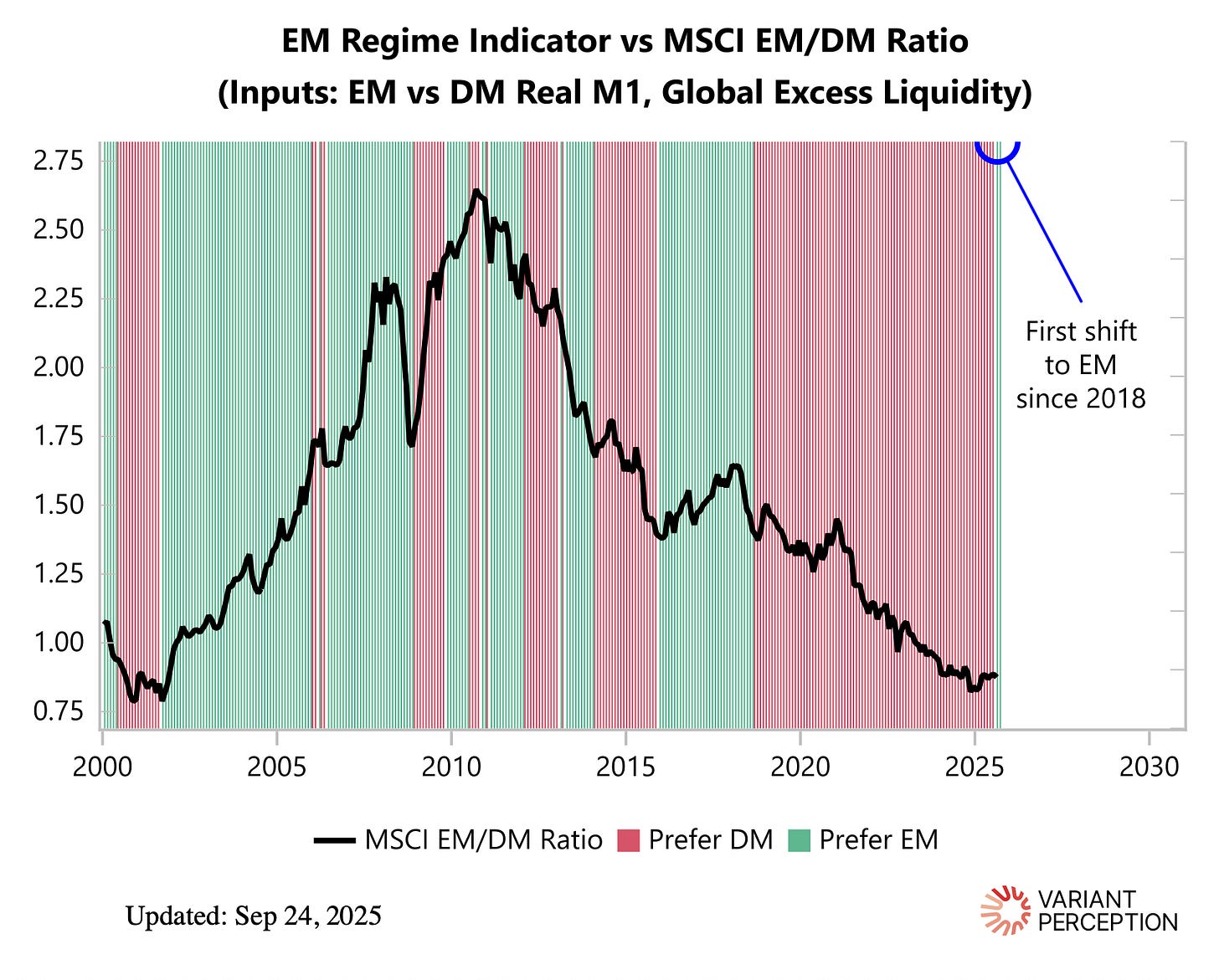

For the first time in seven years, Variant Perception’s EM/DM regime indicator has flipped in favor of EM, based on their read of global excess liquidity.

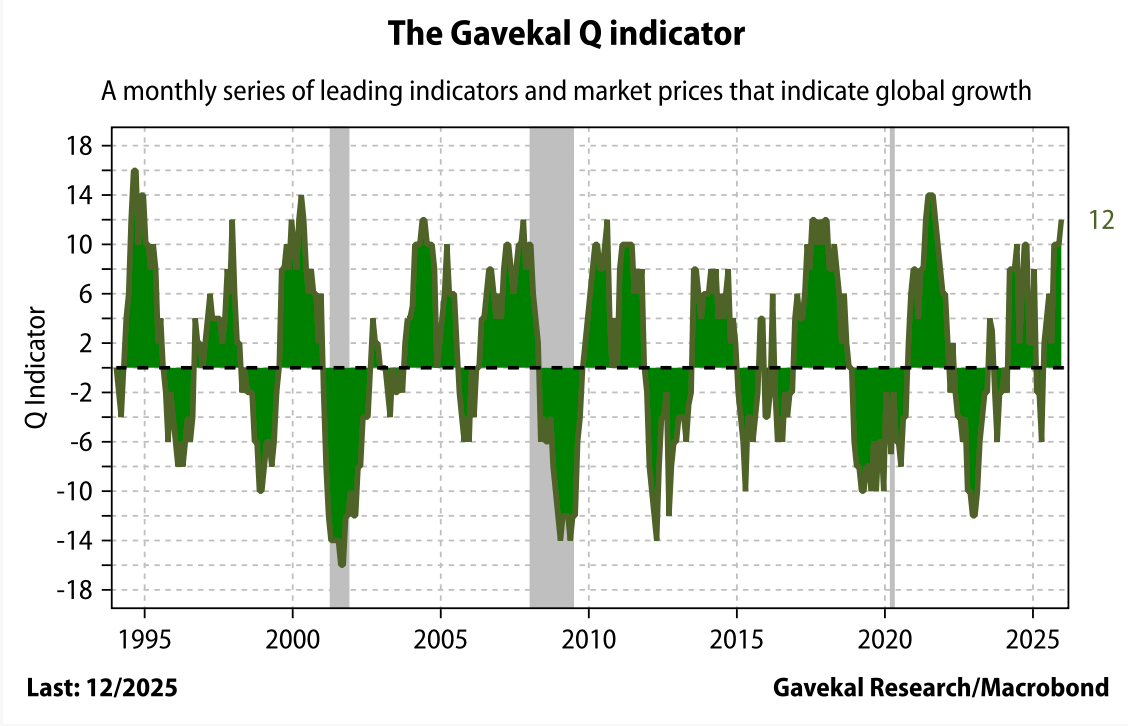

The improving geopolitical and policy backdrop is resulting in global growth forward indicators turning up to the highest levels since 2021.

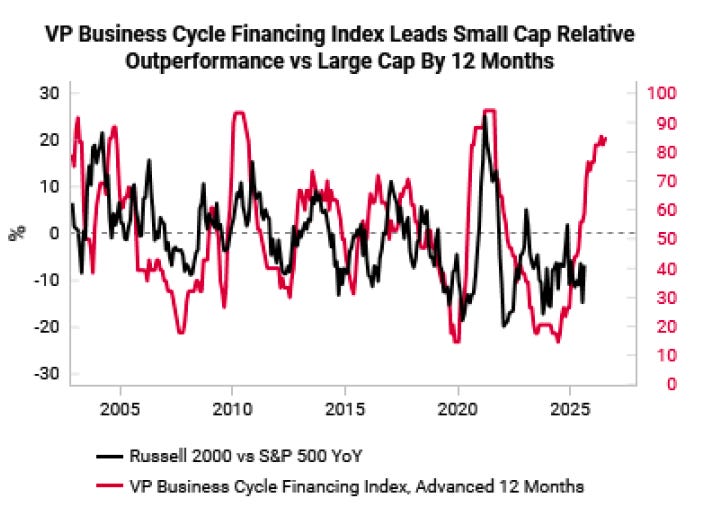

Within the US, the pull factors attracting investors into small caps include the current Fed rate cut cycle that will send short interest rates back to levels close to neutral. With lower interest rates comes relief for broader economy that depends on traditional financing.

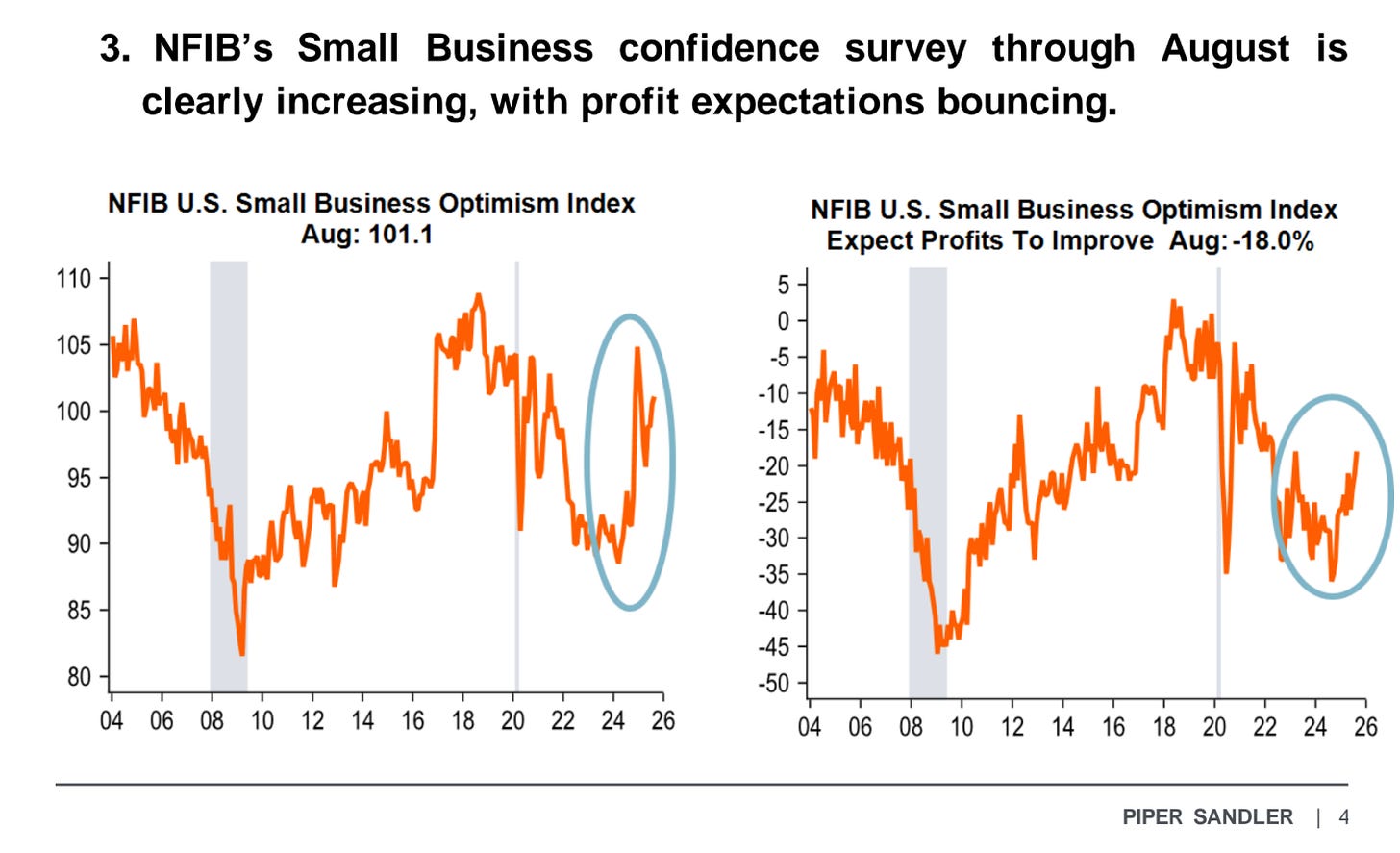

Although the labor market is struggling, there are signs of a broadening of economic growth in sentiment and forward-looking data.

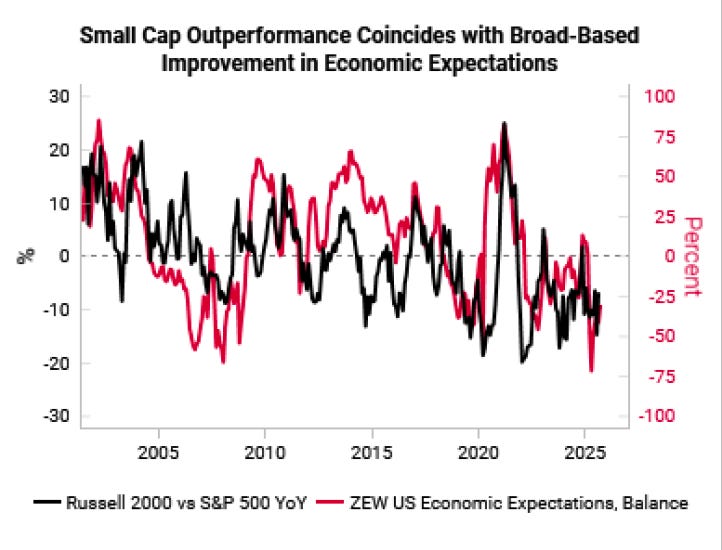

There’s also a strong relationship between small cap outperformance and economic expectations.

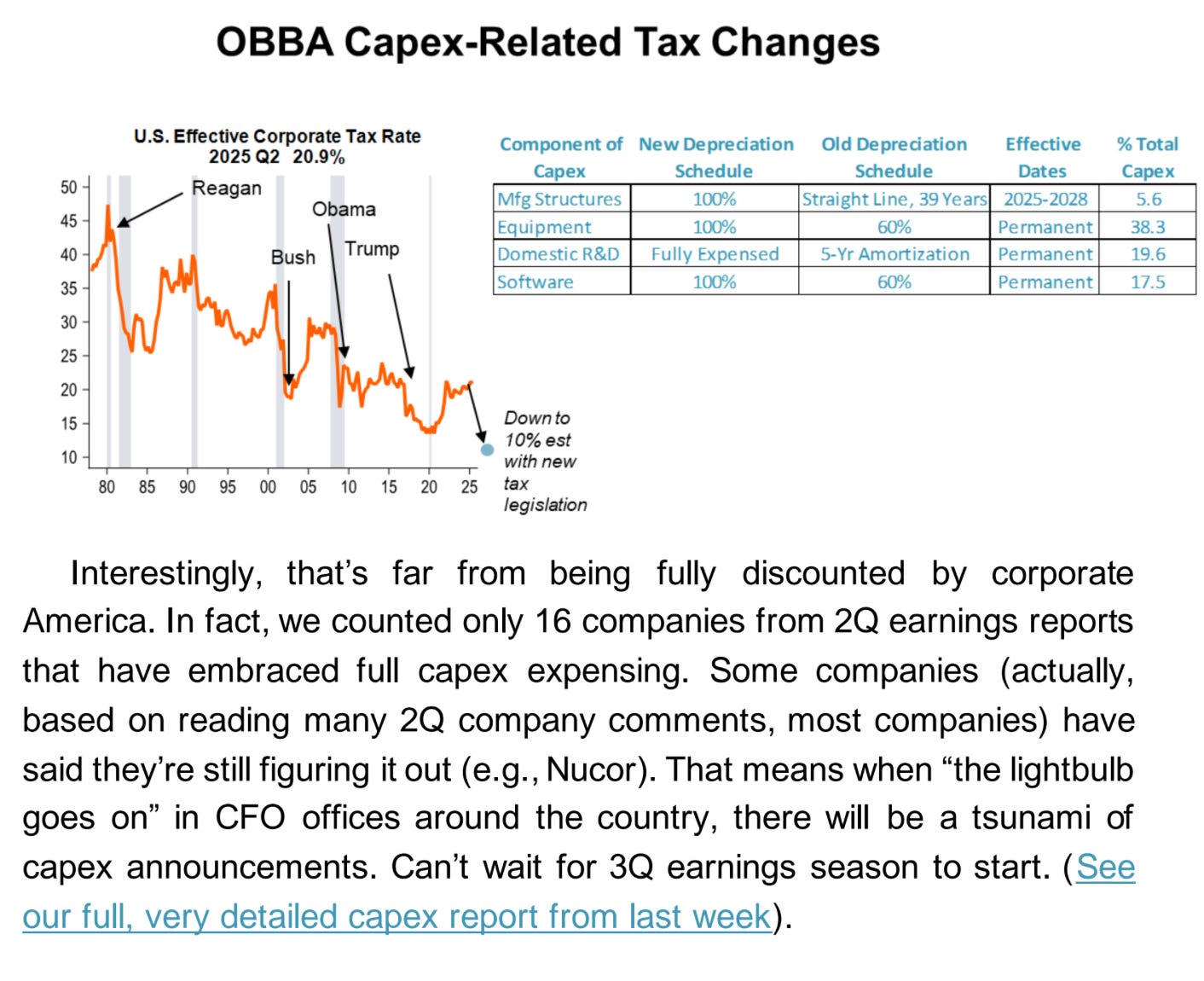

Let’s not forget that the OBBA will supercharge capex in the US and provide fiscal stimulus next year via a lower effective corporate tax rate. This has yet to show up in the numbers, but it’s only a matter of time.

Overall, the dynamics I mentioned above coupled with a Trump-aligned Fed that will keep rates lower for longer than is necessary should result in a long runway for these risk assets to deliver great returns for the next few quarters.

Now, onto the paid subscriber section where I discuss my current positions and add two new trades to express the views above.