What's driving this bull market?

In my last post, I talked about how I was flipping to a bearish position from bullish due to risks around the Fed meeting (which was more hawkish than expected) and non-farm payrolls (which was much weaker than expected). My call was right, but only for two days, after which risk reversed and resumed its trend higher.

Short positions in risky assets should be managed with disciplined stops, so I cut my shorts at a small loss and flipped back to long after the benign US CPI number on Tuesday (alerts went out to paid subscribers).

The bear and bull arguments for risk assets can be summed up in the following:

Bearish

Liquidity withdrawal by the TGA

Weak seasonals for US stock in September

Demand for labor in the US is weak and getting weaker

Inflation is picking back up, which is an impediment to Fed cuts

Bullish

AI earnings and capex are delivering large capital gains for tech investors

Trump administration wants to run the economy hot, and the worst of the tariff policy risk is behind

Business-friendly deregulation, especially in crypto, where deregulation has unlocked tradfi capital to enter crypto

Next year’s Fed composition will veer significantly more dovish

What’s interesting about the current bull market is that it has overcome huge walls of worry to get to where it is now. Trump tariffs, geopolitical hot wars, and stubborn inflation have threatened to derail the bull market this year, yet here we are with the S&P 500 and bitcoin at or near all time highs. The traditional drivers of a bull market - a strong economy and cheap and abundant liquidity - are noticeably absent. The Fed funds rate is arguably restrictive, while the Fed continues to drain liquidity with its balance sheet.

If the liquidity is not coming from the traditional sources of fiscal or monetary expansion, then where is it coming from? I embarked on this thought exercise by looking at the sources of capital fueling the hottest markets, and working back from there.

Let’s start with the resurgence in the prices of unprofitable tech and heavily shorted companies, which have surged this year:

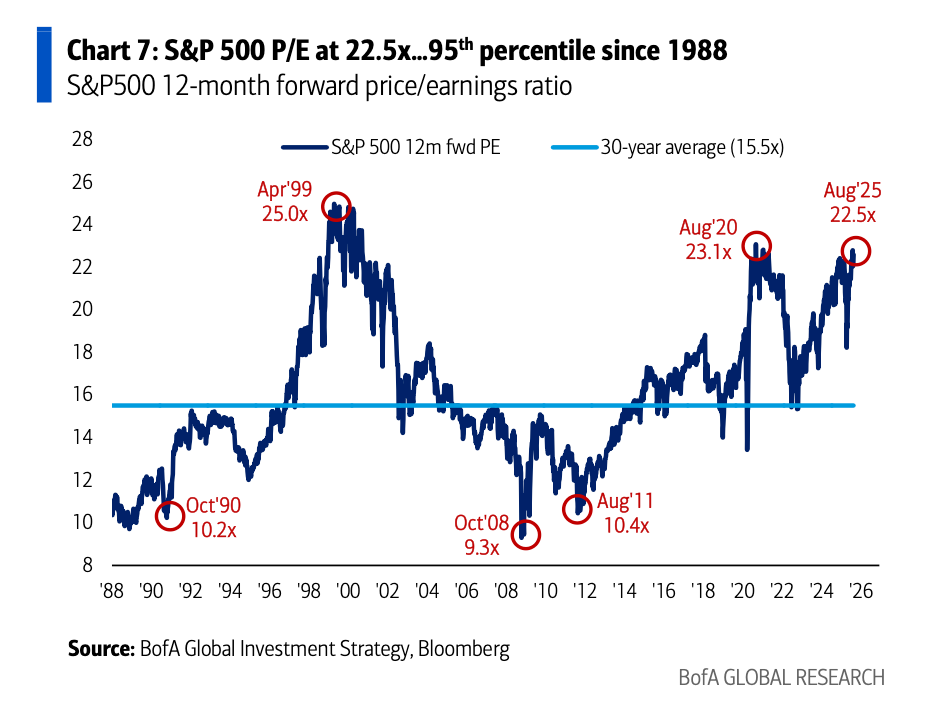

The surge in US stocks has mostly been driven by retail investors, whereas institutional flows have not stood out as the main driver. Whenever the overall index becomes fully priced, as the S&P 500 is currently, investors tend to rotate into riskier assets. With the S&P 500 forward P/E at 22.5x, this is definitely the case today.

The rise of crypto treasury companies has been the key driver of the current leg of the crypto bull market cycle. Trump’s embrace of the crypto industry enabled the proliferation of this new capital structure that is fueling billions of dollars of purchases of BTC, ETH, and other alt coins. Ethereum was a perennial underperformer this cycle, having lost a lot of its revenue stream and growth to layer 2 blockchains. The GENIUS Act enabled stablecoins to become a major source of growth in the Ethereum ecosystem, providing a narrative strong enough for crypto treasury companies to take notice and start accumulating billions of ETH.

Treasury companies such as Microstrategy, Metaplanet, Bitmine, and Sharplink Gaming are taking advantage of bullish investor sentiment to make the market believe that 1+1=3. The beneficiaries are the early anchor investors who invest at a deep discount, as well as the underlying crypto assets that the companies are buying. The retail investors are the ones buying the companies at a premium to NAV, hoping to sell to greater fools while the music keeps playing.

Once again, the gains from US mega caps provide the source for retail investors to move out on the risk curve, driving capital into crypto treasury companies, which in turn drives inflows into spot crypto.

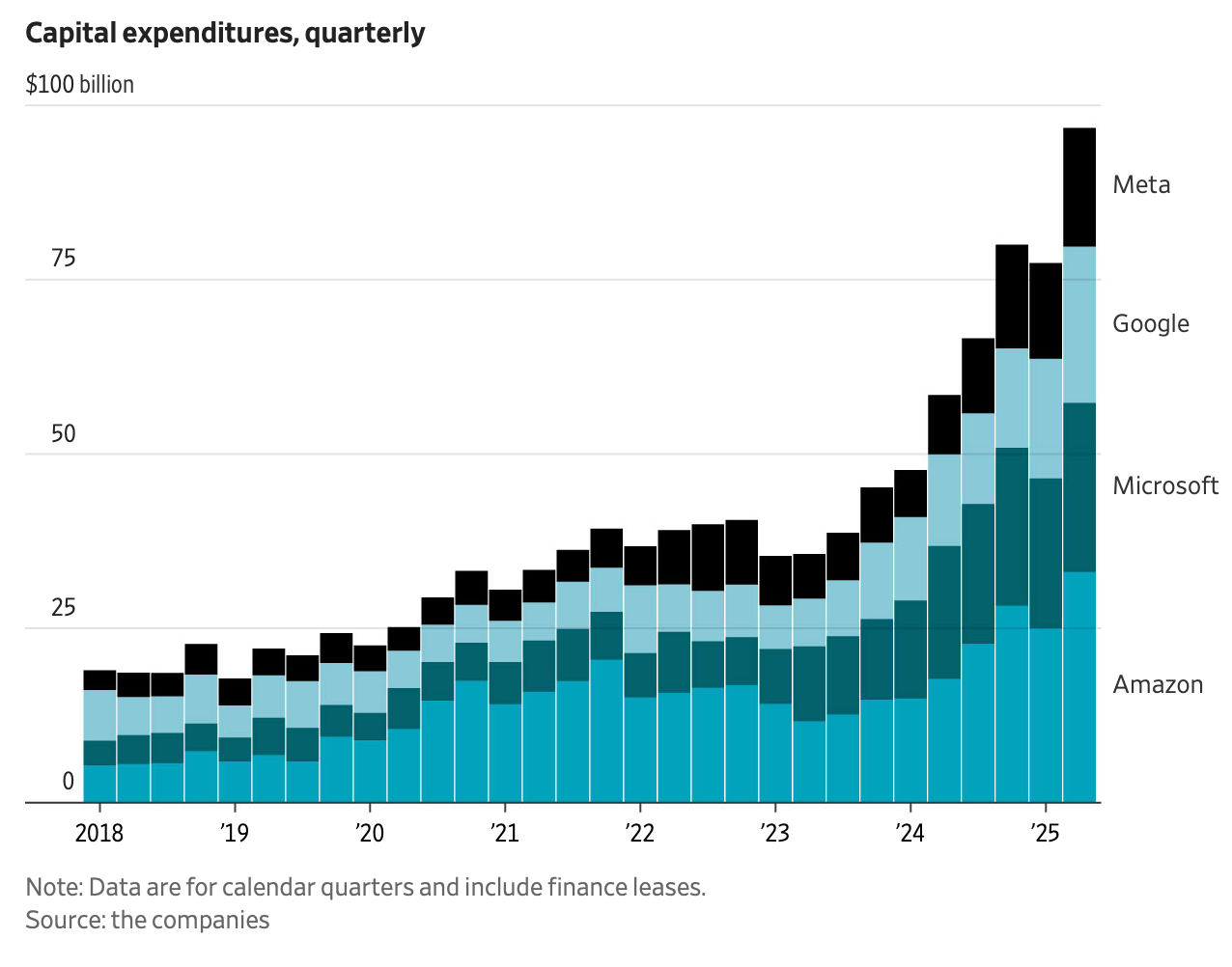

NVDA and MSFT alone have added $3T in market cap since the April lows - enough of a wealth effect for retail investors to rotate into riskier markets and push up prices elsewhere. Silicon Valley’s spending has also created a wealth effect in the real economy, with the MAG7 spending over $100b in capex over the past quarter.

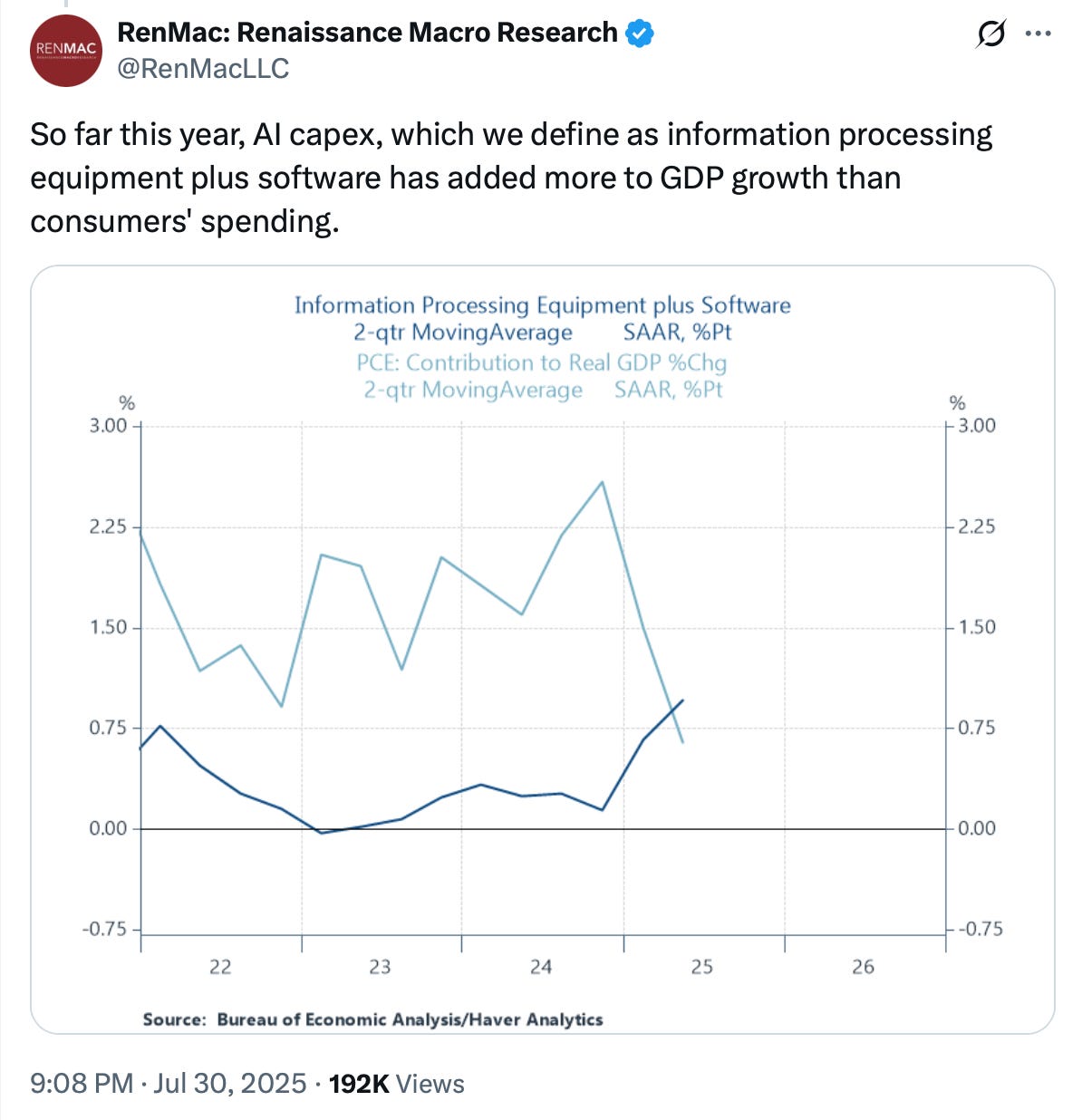

Neil Dutta from Renaissance Macro Research pointed out that AI spending has contributed more to GDP growth than all consumer spending!

The picture is clear when you follow the source of capital flows - AI hyperscalers are at the top of the pyramid of the US economy, trickling liquidity down to the rest of the economy and markets via capex spending and capital gains. If their equity prices and capex spending start to roll over, I would start to turn more cautious on the markets.