Trading results and lessons from 2025

I’d like to thank you all for bearing with my hiatus from writing over the holidays. During my eight years of trading independently, I’ve never fully stepped away from the market and closed every position in the book. In mid-December, I decided to find out what that would feel like, so I closed all positions and made a deliberate choice not to trade and to check emails far less over the following two weeks.

The main benefit was that I could be more present with family and friends and no longer needed to carve out time to stay updated on the market. I spent far less time checking prices on my phone, which allowed me to fully experience each moment with my loved ones amid the snow and nature of Hokkaido, Japan.

The cost of closing all positions and checking out was missing some epic moves in precious metals and copper. I exited silver at 62.88 on December 16, and it went as high as 82. I exited copper at 5.4, and it is now at 6.00. Even if I had not held these positions through my entire vacation, I likely would have captured part of those moves. Watching prices soar created some angst and made me wonder whether I should have taken a middle path: keep existing positions on, but avoid researching new ideas or opening new trades.

Life as an independent trader often comes with choices about the lifestyle consequences of the markets and strategies I trade. I can choose to participate in every promising market, strategy, and investment that comes across my desk. I have tried that approach before, and the result was burnout and strain on my family relationships. Every new strategy or market requires time, energy, and capital, with the desired output being profits. I often see investors with abundant capital pile into each attractive opportunity without fully accounting for the time and energy it will consume, both now and over the life of the investment. They may think they are managing their investments, but over time the investments end up managing them.

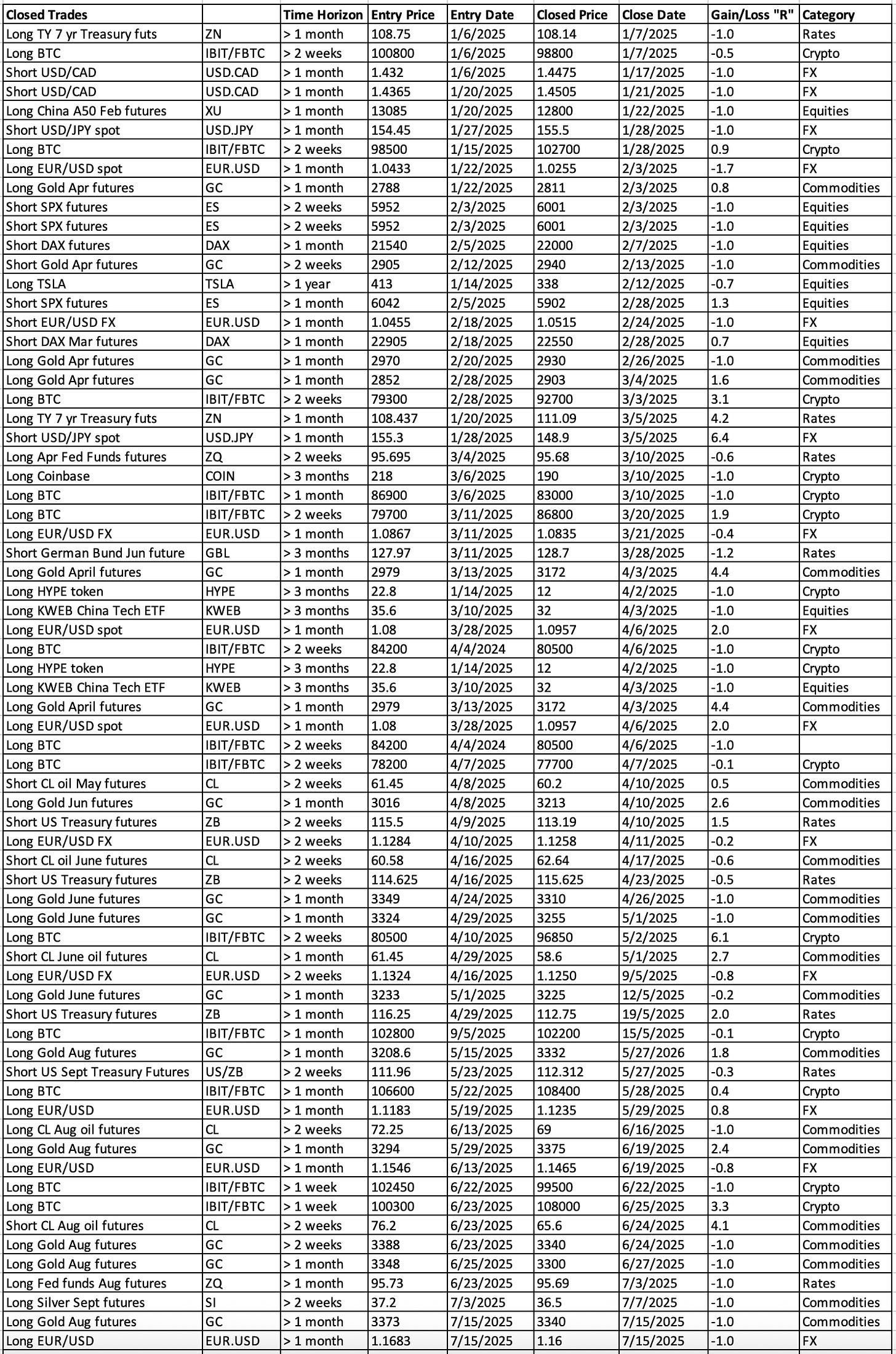

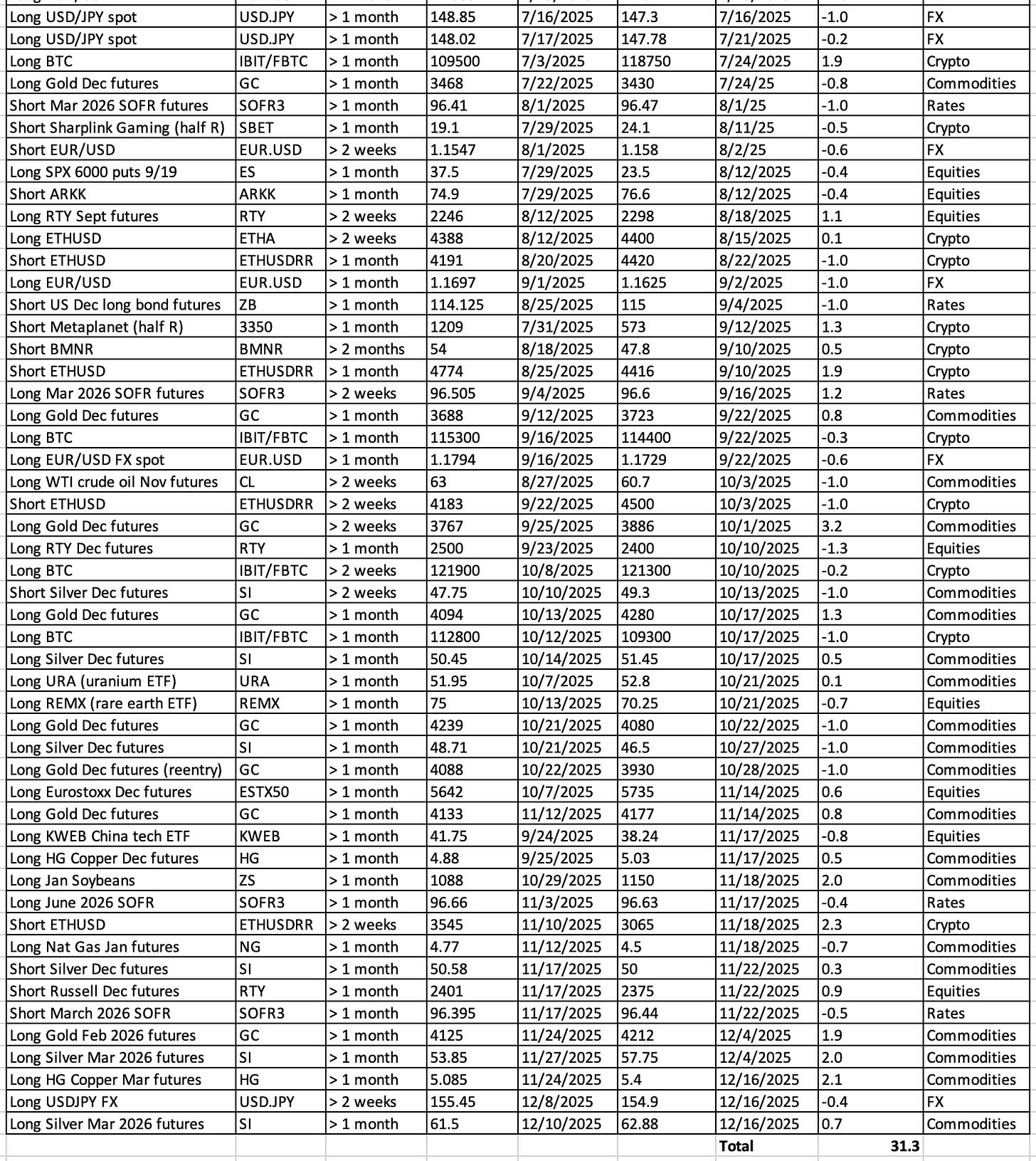

Ever year I recap the performance of all the trades I included in this newsletter and discuss what worked and what didn’t. This was the first year I measured all trades from Jan to December in “R”1 terms, which gives me a consistent measure of how I performed throughout the year across all asset classes. Overall, trades mentioned in Fidenza Macro delivered 31.3 R over 120 trades, while my S&P futures swing trading strategy delivered 31.5 R over 88 trades. Combined, they produced close to a triple‑digit percentage return, driven by risking 0.75 to 2% of capital per trade and sizing up as the account grew. All trades mentioned in the paid subscription of Fidenza Macro are listed at the end of this letter.

Commodities were my most profitable asset class, generating 24.9 R. Gold was my best market, with 15.9 R of profit. Given the strong uptrend that allowed me to focus mainly on the long side, this outcome is not surprising. Gold has been one of my most profitable markets since I began trading it in 2017.

Even so, it is hard not to think about the major rallies in precious metals that I failed to capture because I took profits too early or tightened stops too aggressively. I barely made money in silver, which is unacceptable given the strong bull trend in Q4. I traded position sizes that were too large for the higher volatility regime, which forced me into stops that were too tight. Poor sizing often leads to poor decisions, and this is a mistake I intend to avoid in the future. I still believe we are in a multi‑year bull market in precious metals, so I need to adapt my trading style to ensure I capture more of the move.

Crypto was my next most profitable asset class, with 12 R of returns. I am satisfied with this result given how challenging crypto was for most traders in 2025. I caught most of the BTC rallies between 80–120k and made some money shorting ETH and digital asset treasuries in Q4. I do not expect to repeat this performance in crypto this year, as I anticipate a choppier environment.

My trading in rates produced a modest 1.6 R, reflecting the rangy price action and conflicting narratives. As the global central bank rate‑cut cycle matures and short‑end interest rates bottom out, I suspect rates markets will remain largely sideways and choppy.

My equity and FX trades lost a combined 7.2 R. I do not feel too bad about FX, given how notoriously difficult that asset class is, but I am leaving a lot of potential gains on the table in equities. I have not yet found a reliable way to express my macro views through equities and ETFs. I often end up out of sync with the market and focused too much on short‑term swings because I lack conviction. I do not yet have a clear answer on how to improve my equity results, so any guidance from readers is welcome.

My next letter will be about the themes I’m currently focused on, along with my first trades of the year. Stay tuned!

All trades closed in 2025

Disclaimer: The content of this newsletter is provided for informational and educational purposes only and should not be construed as professional financial advice, investment recommendations, or a solicitation to buy or sell any securities or instruments. The newsletter is not a trade signaling service and the author strongly discourages readers from following his trades without experience and doing research on those markets. The author of this newsletter is not a registered investment advisor or financial planner. The information presented on this newsletter is based on personal research and experience, and should not be considered as personalized investment advice. Any investment or trading decisions you make based on the content of this newsletter are at your own risk. Past performance is not indicative of future results. All investments carry the risk of loss, and there is no guarantee that any trade or strategy discussed in this newsletter will be profitable or suitable for your specific situation. The author of this newsletter disclaims any and all liability relating to any actions taken or not taken based on the content of this newsletter. The author of this newsletter is not responsible for any losses, damages, or liabilities that may arise from the use or misuse of the information provided.

When I enter a trade, I set a predetermined stop loss and risk a percentage of my trading capital towards betting that the market will move in my favor and won’t trigger my stop. If I do get stopped out, I lose that predetermined amount of capital, represented by “R”. If I take profit and make four times what I would have lost if I got stopped out, the trade is a 4R winner. The goal of trading is for the sum total of the R column to be as high as possible. The reason I track my gains and losses in R terms and not in percentage or dollar terms is to account for the fact that I trade many different assets with varying volatility, and the only constant between those markets is the percentage of trading capital I risk on each trade. Two traders who choose to copy my trades would have vastly different results if one of them uses five times more leverage than the other. A mediocre trader who makes a few lucky trades in volatile assets can boast of better percentage returns than a more skilled trader who trades less volatile assets. “R” is the one measure you can’t obfuscate and is one of the best determinants of the skill of a trader.

Congrats on another excellent year!

Congrats on a phenomenal year Geo